Your Money,

Your Future — Simplified.

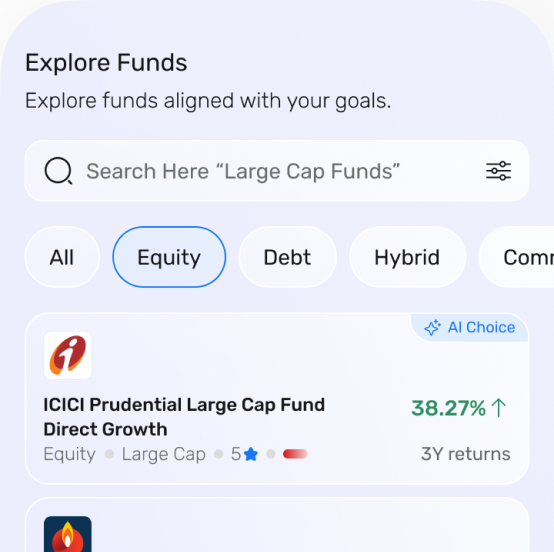

Equity

Hybrid

Debt

Unlock the dual power of your money

Continue your investment journey while unlocking liquidity when needed.

Loans against Mutual Funds

Unlock instant liquidity by pledging your mutual funds — without redeeming your investments

Trusted AMC's

Returns Calculator

Understand your investment outcomes better. Calculate expected returns and plan your financial journey with ease.

SIP

Lumpsum

SWP

Calculating returns is only the first step. To turn numbers into real outcomes, invest in mutual funds aligned to your goals and risk using the FundsApp.

Investment vs returns

Total value of investment

₹0

Invested

₹ 0

Returns

₹0

FAQs

Common questions answered to help you get started with FundsApp.

FundsApp is a platform that enables investors to explore, invest, and manage mutual fund portfolios digitally. It also provides tools for financial distributors and advisors to onboard clients, execute transactions, and monitor their business growth.

FundsApp follows all compliance standards set by SEBI and AMFI.

No. The entire journey, including onboarding and KYC, is digital and designed to be simple and hassle free.

- Aadhaar

- PAN

- Bank account proof

- Selfie/photo for verification

Yes. FundsApp operates in line with applicable SEBI and AMFI guidelines and follows strong security practices to protect user data and transactions.

Yes. The app consolidates all your holdings—even investments made outside—through PAN-based tracking.

- Client onboarding links

- AUM & Brokerage dashboard

- SIP/bookings tracker

- Business reports

- Digital document kits

Yes, everything is done online — from checking eligibility to signing and pledging.

No paperwork is needed.

There are no hidden charges.

A small processing fee may apply and will be shown clearly before approval.

Yes, your SIPs will continue as normal, but you cannot redeem or switch the pledged units until you repay the loan.

Because it’s quick, safe, and 100% online.

You get instant approval, transparent charges, and you can keep earning returns while using your money.