Invest in Mutual Funds

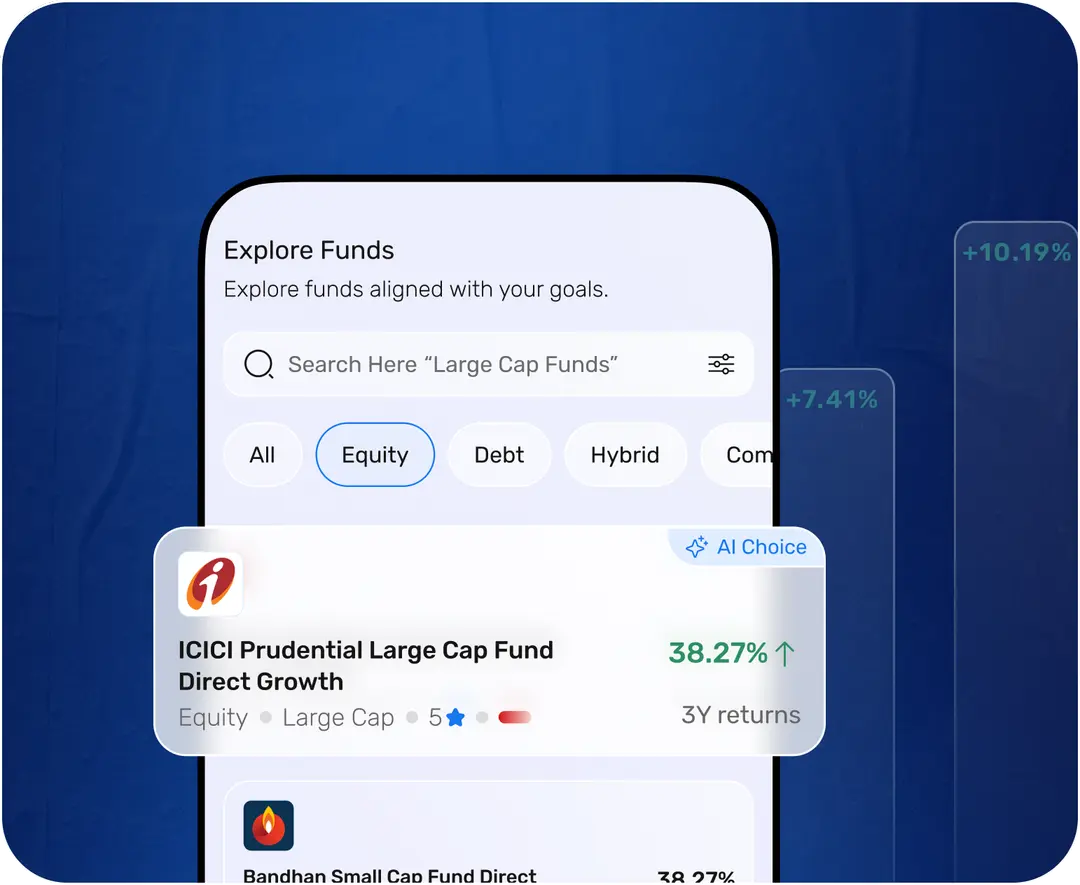

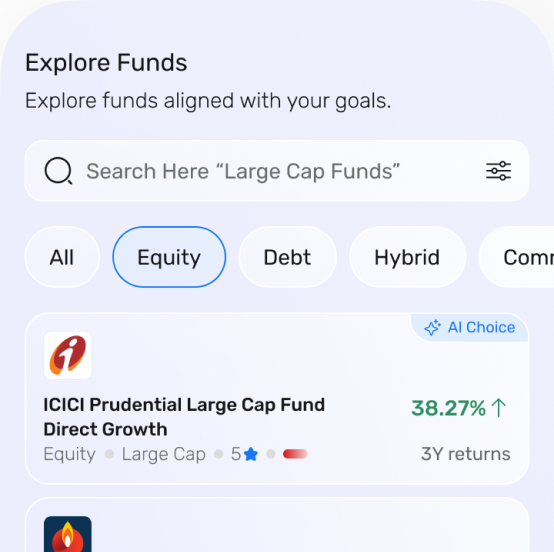

Invest in 1600+ Mutual Funds in India. Set up SIPs with UPI Autopay and build portfolios using goal-based guidance and recommendations aligned to your risk profile. Manage SIPs with full control to edit, pause, or cancel anytime, and invest in lumpsum whenever you choose.

Get Started

What are Mutual Funds ?

- Mutual funds pool money from many investors and invest it across equity, debt, and hybrid instruments—making diversification simple and accessible.

- These funds are managed by professional fund managers from reputed AMCs, who work to grow your investment while managing risk effectively.

- Mutual funds offer categories suited to different goals and risk profiles, including growth-focused equity funds, stable debt funds, and balanced hybrid options.

- You can start investing with small SIP amounts or through lump sum contributions, with the flexibility to increase, pause, or modify anytime.

- Most mutual funds have no lock-in (except ELSS), giving you the freedom to redeem whenever needed—ideal for both short-term and long-term goals.

Invest via SIP or lump sum

No lock in on most funds

Goal and risk aligned guidance

Track and manage easily

Benefits

Why should you trust Fundsapp for your mutual fund investments.

Diversification

Invest across different asset types to balance risk and achieve more stable long-term growth.

Professional Management

Experienced fund managers handle all research, selection, and investment decisions on your behalf.

Affordability

Begin with small amounts and still access well-diversified portfolios managed by trusted AMCs.

Liquidity

Redeem your units anytime with ease, giving you quick access to your money whenever you need it.

Flexibility

Pick funds that suit your goals, whether you prefer growth, stability, or a balanced approach.

Regulated and Transparent

Backed by SEBI regulations with clear disclosures, ensuring safety, trust, and transparency at every step.

Ways to invest in MF

Start with SIPs or make one-time investments that match your goals and risk profile.

SIP (Systematic Investment Plan)

SIP lets you invest a fixed amount at regular intervals. It is one of the most effective ways to invest in mutual funds, helping you stay disciplined while averaging the cost of your investments over time.

Lumpsum Investment

A lumpsum investment is a one time contribution made at once. It is often used when you have extra money available, such as a bonus or savings, allowing you to invest a larger amount instantly.

Questions? Answers

Common questions answered to help you get started with FundsApp.

A mutual fund pools money from multiple investors and invests it in a diversified portfolio of equities, bonds, or other securities, managed by professional fund managers.

Exit load depends on the scheme. It is disclosed before redemption and included in the scheme documents.

- SIP/Buy: Same day or next business day

- Redeem: 1–3 business days depending on the fund

- Switch: Usually 1 business day

Most open-ended mutual funds allow redemption at any time, except ELSS funds, which have a lock-in period.

Yes. Taxation depends on the type of fund and holding period. Capital gains tax rules apply as per government regulations.

Equity funds invest primarily in stocks for higher growth, while debt funds invest in fixed-income securities for relatively stable returns.

Yes. Investing in multiple funds across categories improves diversification and helps manage market risk.

Missing a SIP installment does not attract penalties. The SIP continues unless multiple payments fail.

Mutual fund assets are held by a trustee and custodian, ensuring investor money remains protected.

CAS is a single statement showing all mutual fund investments across AMCs under one PAN.

Yes. NRIs can invest on a repatriation or non-repatriation basis, subject to KYC and FATCA compliance.